May 31, 2021

The alternative financing options have been existing for decades but following the Great Recession in the middle of 2000s they grew rapidly and captivated attention within professional and public realm. It’s interesting to investigate the nature of alternativeness of some selected alternative financing options as such dissection may help to better understand what they are standing for

The alternative financing options have been existing for decades but following the Great Recession in the middle of 2000s they grew rapidly and captivated attention within professional and public realm. It’s interesting to investigate the nature of alternativeness of some selected alternative financing options as such dissection may help to better understand what they are standing for

Since the end of commodities supercycle and downturn followed as from the middle of 2010s and up till now the miners were struggling to secure funding either for development and expansion projects or for refinancing of old debt or M&A. The abundance of funding which in the past was riding on the booming prices during the supercycle dried out and the sector faced serious funding limitations.

Public-debt and public-equity options became quite hardly to be arranged while private-debt and private-equity options were developing at a not satisfactory and not enough pace unable to meet the needs of the sector. In such circumstances certain alternative financing options and techniques – nevertheless known for years – blossomed; also, there are all grounds to believe they may play a significant role for the sector for years to come.

According to the estimate of McKinsey & Co. about US$ 8 trillions assets under management are dedicated to alternative financing whereon the share of mining projects accounts for somewhat 1% of the said amount or around US$ 10 to 15 billion. Also, it is estimated that alternative financing may add impressive US$ 800 billion to mining projects alternative financing portfolios within following 10 years to come.

So, the potential of alternative financing structures seems to be so huge, that’s why it is interesting to investigate in more details some most popular alternative financing options in order to understand the nature, pros and cons as well as risks inherent to those financing options.

Some specific and interesting feature of certain alternative financing structures is that they – if certainly structured as not fixed commitments – are not creating debt for the projects and thus do not burden the balance sheets of the borrowers. With regard to that we will particularly investigate such options.

Royalties have been well known for centuries as payments to sovereign for exploring natural resources or using other property or assets owned by such sovereign. There could be different models for determining the royalty payment starting from defining it as a fixed amount for one unit of resources sold – for example certain amount for one ton of minerals sold – and finishing with certain percentage of the revenue received as a result of using a property or an asset.

In the context of financing operation, the royalty agreement envisions that certain up-front payment is made by the financier to the borrower and once the project generates revenue the financier is being got paid in a form of royalty in accordance with the pre-defined model. Royalty agreements do not have any connection with any specific commodity being manufactured by the miner, they are so-called commodity agnostic – an overall miner’s revenue serves as a basis for determining amount of royalty due.

We would say that this option is a sort of modification of the previous one with the deference regarding the basis which is used to determine payments to financier. In this case payment are determined on the basis of amount of revenue less operational and some other costs which are agreed between the parties, including in some cases CAPEX born by the miner.

Streaming agreements are by nature long-term commodity purchase contracts whereof the financier makes cash up-front payment to the miner and purchases a defined commodity which is being produced by the miner with certain discount to the spot prices which shall prevail on the market in future. So, the streaming agreements are tied to certain commodity.

The first known example of streaming agreement was the one made in 1987 related to Goldstrike gold mine in Nevada. Since that time the streaming model has been rather actively used in the Northern and Southern America with predominant focus on gold and silver mining sectors, however, with the lapse of time, it also penetrated into some other sectors, commodities and minerals.

It’s very often supposed that alternative financing structures have certain features that advantageously distinguish them from the traditional financing options like loans, debt and equity financing structures. However, in this article we are going to investigate in some more details whether this is so and if so to what extent they are different … or alike.

The features which are inherent to alternative financing options could be examined from two standpoints, the first, the point of view of miners, and, the second, the point of view of financiers. Hereinafter we are going to analyze them separately.

Major advantages of alternative financing options

– in particular royalty, NPI and streaming agreements – from point of view of the miners are as follows:

– Often longer payment period;

– No fixed obligations in cash, so they present less risk during periods of lower prices;

– Limited restrictions on the use of cash;

– No debt covenants to maintain;

– Sharing production and operational risks across the value chain.

Taking into account that the above-mentioned advantages are to certain extent a sort of generalization, it’s obvious that many advantages of those financing options are, on the other hand, disadvantageous to the financiers as they do not establish many mechanisms that had evolved long ago with the purpose of minimizing risks and protecting the interests of the lenders and investors.

Possibly there are some other features and mechanisms that may counterweight the disadvantages of, say, more dilutive approach practicable in a context of the above-mentioned financing options.

We could hardly find any advantages that could be inherited specifically to the said alternative financing structures and that could be impossible to get implemented into or arise out of the traditional financing arrangements.

It is, however, quite often estimated that streaming and royalty financing options are very beneficial for investors and deliver to such investors higher returns than other investment options

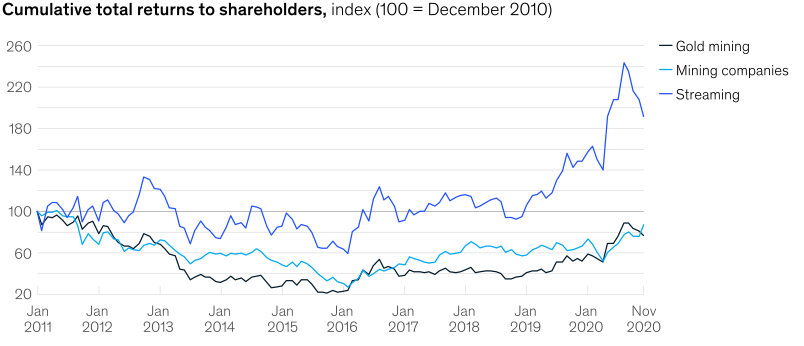

The data prepared by McKinsey & Co. shown above demonstrates that for the lest 10 years the cumulative returns delivered by the streaming vehicles to their shareholders outperformed the returns delivered by the mining sector itself and by investments into gold quite substantially to say the least. At the same time, it is visible that streaming vehicles investments had a closer correlation with the investments into metals.

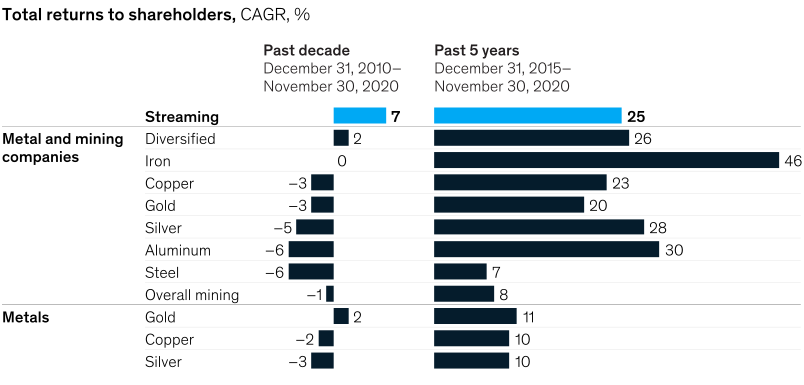

According to the data prepared by McKinsey & Co. alike picture is seen if the streaming vehicles performance is compared with the broader steel, minerals and metals industry performance, however, in this case the streaming – practicable mainly in gold and silver sectors – demonstrates on some selected shorter time scale worse results which are nevertheless better than investments into metals, somewhat comparable with results of investing into selected mining and metal sectors and quite better than investing into overall mining.

We will try to come up with our interpretation of benefits that streaming and royalty vehicles deliver to their shareholders and which distinguish them from traditional financing options or in other words make them alternative.

The first, more often than seldom streaming and royalty vehicles benefit very long – if not infinite – period of having interest in a given mining company. That means, from certain standpoint, that streaming or royalty vehicle shall actually become a quasi-shareholder of the mining company.

At the same time, one may notice that such companies, with royalty companies to some lesser extent, shall not be dependent and less dependent respectively on the mining company’s dividend policy and financial standing and effectiveness.

The second, irrespective of the fact the streaming and royalty company shall be exposed to metals and minerals markets, they will seem to stay beyond risks relating to prices as the steaming and royalty agreements mostly deal with quantity of mineral and metals produced or off-take prices determined as discounted spot prices so the margin of the financier shall be to certain extent fixed.

The third, streaming and royalty companies are more cost effective when compared to mining companies and traditional financing institutions, as they run narrowed spectrum of operations, and due to that they may deliver higher returns to their shareholders.

At the same time, the approach used by streaming and royalty companies to evaluation of the projects not very much differs from that of traditional financial institutions and structures, as the streaming and royalty companies need to evaluate almost the same factors like operational and geological risks, geographic and political, legal and financial risks where evaluation of those risks should prove the feasibility of the project in a long run.

The so-called alternative financing structures, like streaming and royalty financing arrangements mainly discussed in this article, seem to statistically proved their beneficial nature for financiers arranged such structures and investors of streaming and royalty companies.

We do consider that this was achievable due to some specific features of such arrangements, for example – and we think mainly to – quasi-shareholding nature of relations between financiers/investors of these vehicles and mining companies but less dependence on mining companies’ policies, financial standing and effectiveness. Cost effectiveness of streaming and royalty companies is also a crucial factor of success.

At the same time, nevertheless that streaming and royalty companies could demonstrate good track record their history is rather short to make any final conclusions and current dominance in terms of returns is subject to further observation and critical analysis.

However, our reflection regarding discussed structures tells us that their, say, alternativeness really exists and we consider that this is that features which creates quasi-shareholding relations between financiers and streaming/royalty companies and mining companies but with less or no dependencies on financial standing and effectiveness or companies’ internal policies toward formal shareholders.

In case of any queries or for obtaining further information please contact office.poland@primeore.eu